April 2022

THE COST OF CONVENIENCE: RIDEHAILING AND TRAFFIC FATALITIES

WITH JOHN M. BARRIOS (Washington University in St. Louis & NBER) HANYI YI (Boston College)

We examine the effect of the introduction of ridehailing in U.S. cities on fatal traffic accidents. The arrival of ridehailing is associated with an increase of approximately 3% in the number of fatal accidents, for both vehicle occupants and pedestrians. Consistent with ridehailing increasing road usage, we find that introduction is associated with an increase in proxies for traffic congestion and with new car registrations. Consistent with a driver quality channel, accident increases are concentrated in ridehailing-eligible vehicles and those with passenger configurations suggestive of ridehailing. Back- of-the-envelope estimates of the annual cost in human lives range from $5.33B to $13.24B. We propose a variety of operational as well as policy prescriptions for regulation of ridehailing operations that may help limit such externalities.

PDF

April 2022

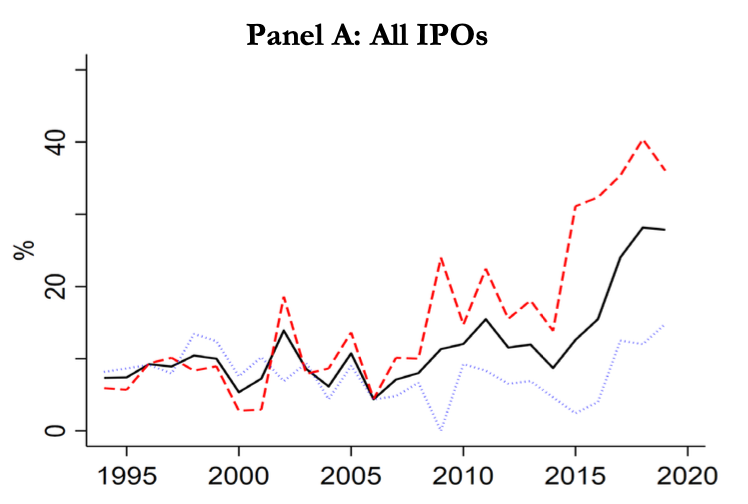

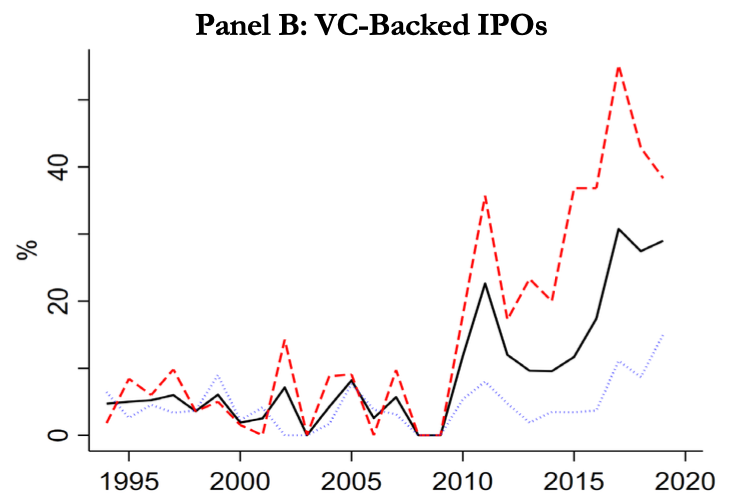

The Rise of Dual-Class Stock IPOs

WITH DHRUV AGGARWAL (Yale University) OFER ELDAR (Duke University) LUBOMIR P. LITOV (University of Oklahoma)

We create a novel dataset to examine the recent rise in dual-class IPOs. We document that dual-class firms have different types of controlling shareholders and wedges between voting and economic rights, and that the increasing popularity of dual-class structures is driven by founder-controlled firms. We find that founders’ wedge is greater when founders have stronger bargaining power. The increase in founder control over time is due to greater availability of private capital and technological shocks that reduced firms’ needs for external financing. Stronger bargaining power is also associated with a lower likelihood of sunset provisions that terminate dual-class structures.

PDF

September 30, 2021

revised version

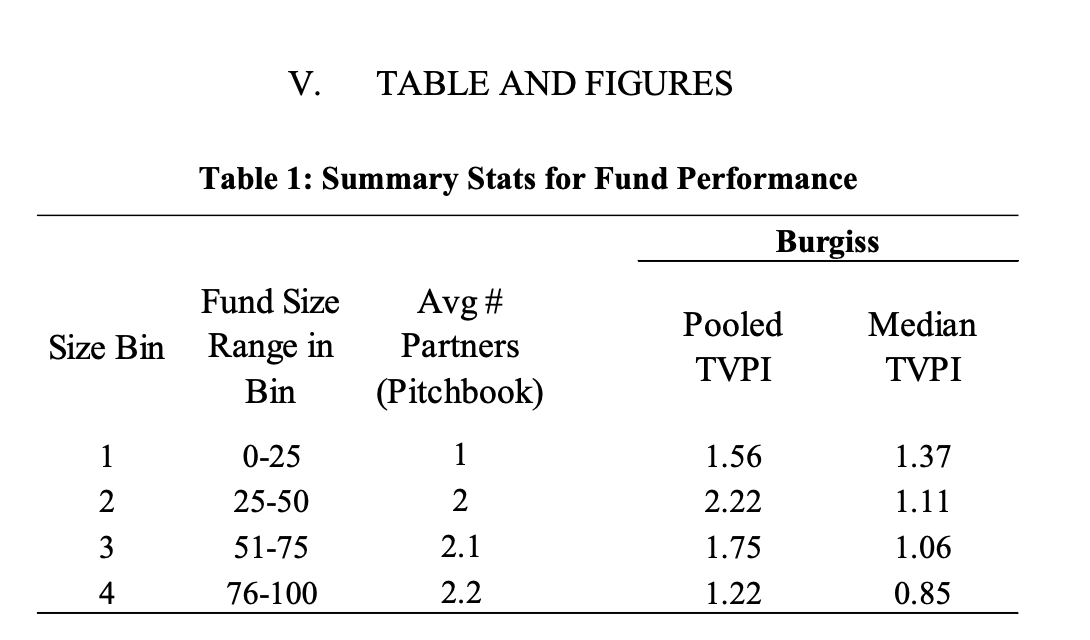

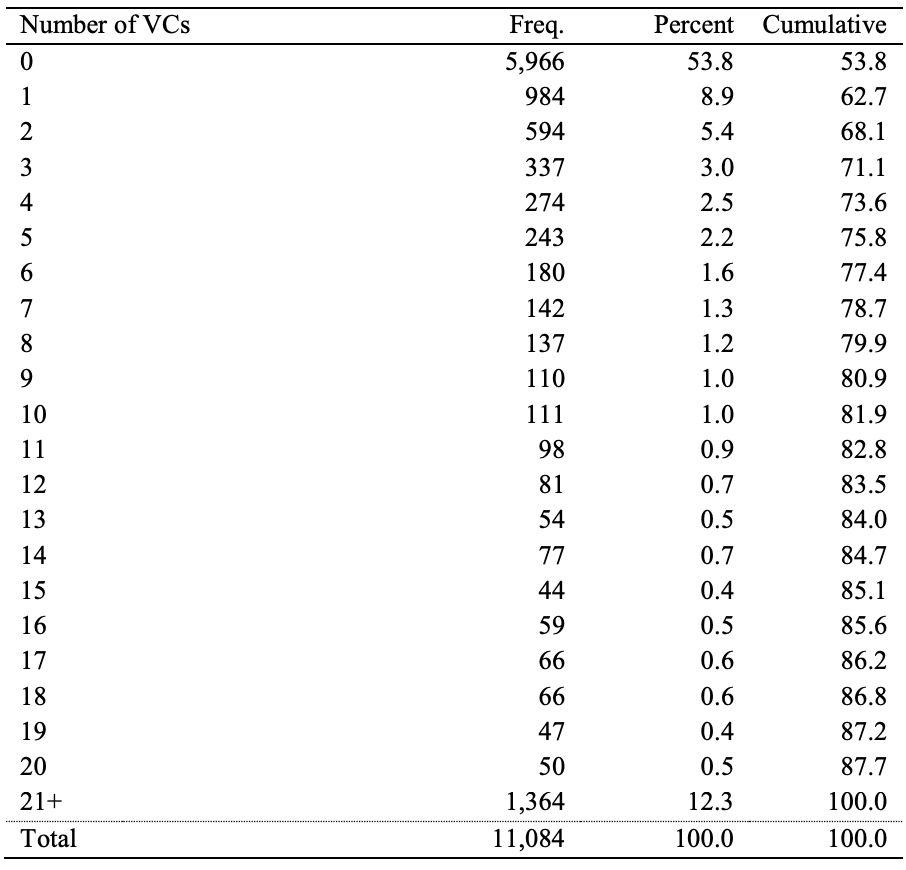

TAXING CARRIED INTEREST AS ORDINARY INCOME AND THE POTENTIAL IMPACT ON NEW VENTURE FUND FORMATION

WITH JOHN M. BARRIOS (Washington University in St. Louis & NBER)

We explore the potential impact of taxation of carried interest at ordinary income rates on the economic attractiveness of new VC fund formation and its potential impact across US states. Our analysis suggests that changing the taxation regime for carried interest from taxation at (long-term) capital gains rates to ordinary income rates would significantly reduce the attractiveness of forming a new fund for the vast majority of funds in U.S. states other than CA, MA and NY. These funds are predominantly smaller, earlier stage funds, and represent a significant proportion of available VC funding sources outside of the traditional Big 3 VC states. Given the importance of VC funding for U.S. innovation, our findings may serve to inform and aid policymakers in their current deliberations as they consider, design, and implement potential new tax laws that will affect the VC industry.

PDF

April 22, 2020

LAUNCHING WITH A PARACHUTE: THE GIG ECONOMY

AND NEW BUSINESS FORMATION

WITH JOHN BARRIOS (University of Chicago) LIVIA HANYI YI (Rice University)

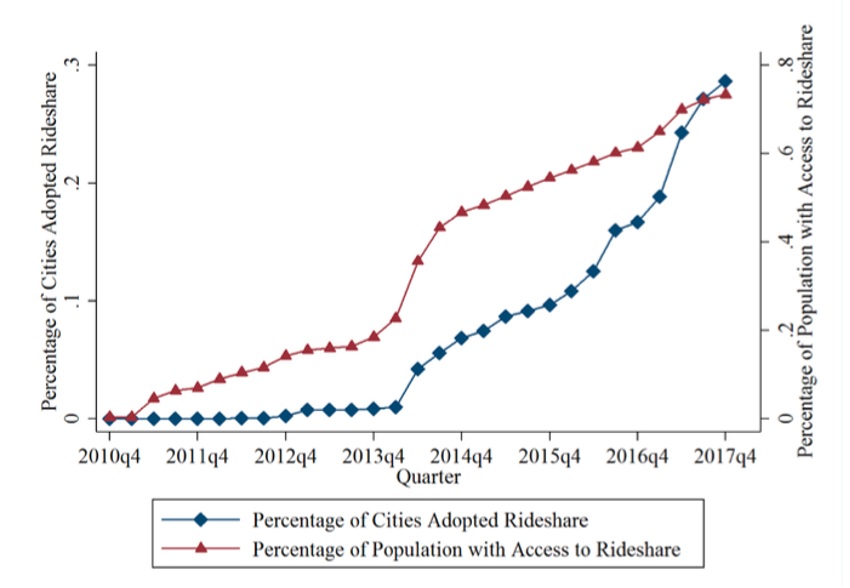

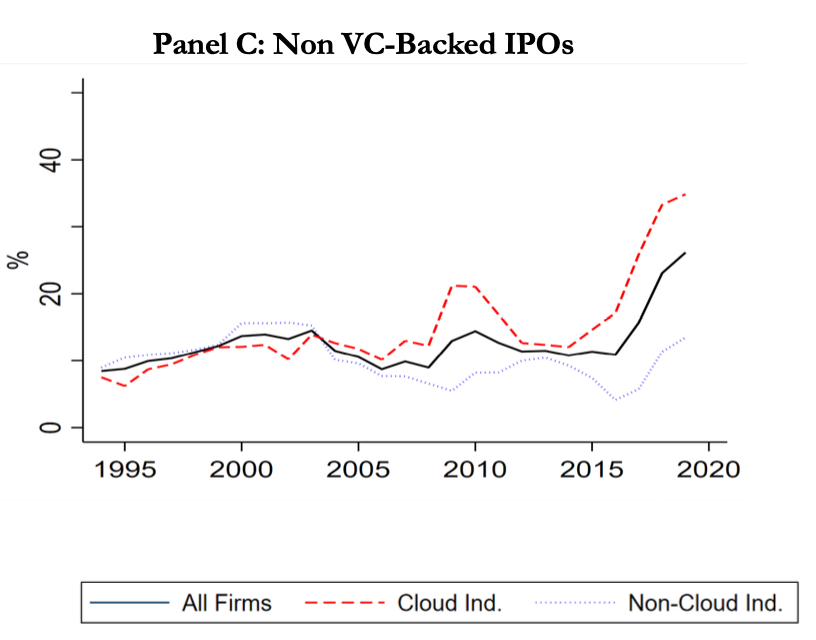

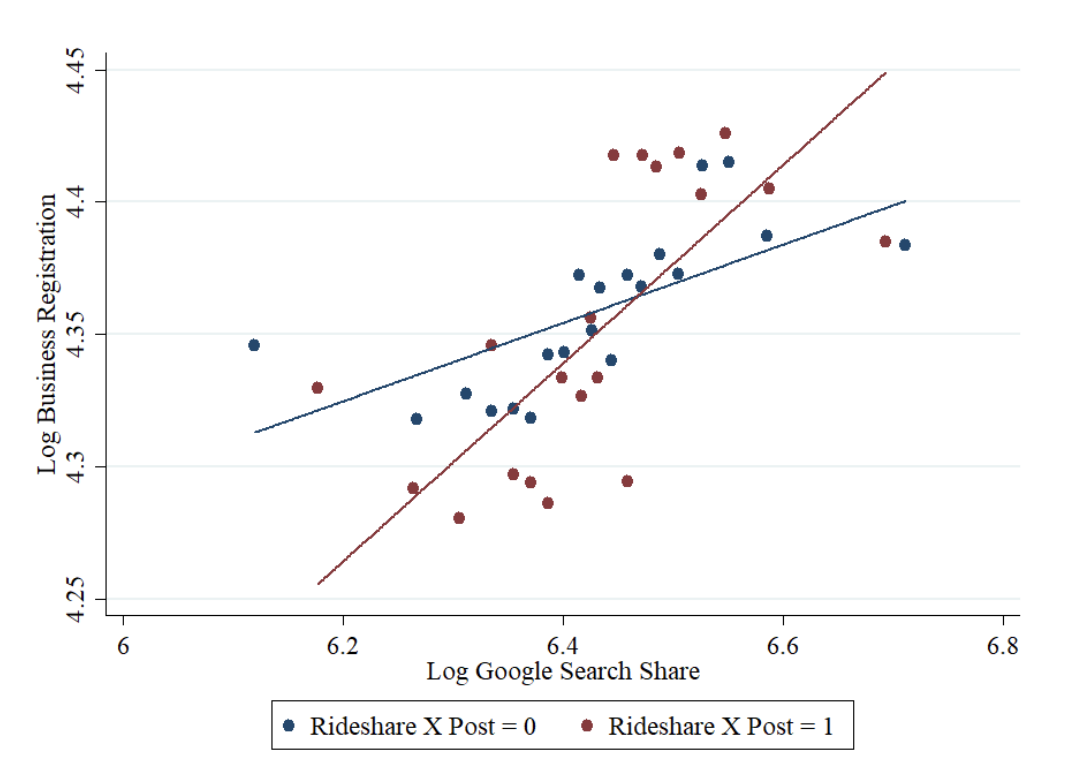

The introduction of the gig economy creates opportunities for would-be entrepreneurs to supplement their income in

downside states of the world and provides insurance in the form of an income fallback in the event of failure. We present

a conceptual framework supporting the notion that the gig economy may serve as an income supplement and as

insurance against entrepreneurial-related income volatility, and utilize the arrival of the on-demand, platform-enabled

gig economy in the form of the staggered rollout of ridehailing in U.S. cities to examine the effect of the arrival of the

gig economy on new business formation. The introduction of gig opportunities is associated with an increase of ~5% in

the number of new business registrations in the local area, and a correspondingly-sized increase in small business

lending to newly registered businesses. Internet searches for entrepreneurship-related keywords increase ~7%, lending

further credence to the predictions of our conceptual framework. Both the income supplement and insurance channels

are empirically supported: the increase in entry is larger in regions with lower average income and higher credit

constraints, as well as in locations with higher ex-ante economic uncertainty regarding future wage levels and wage

growth.

PDF

October 7, 2020

CIVIC CAPITAL AND SOCIAL DISTANCING DURING THE COVID-19 PANDEMIC

WITH JOHN M. BARRIOS (Washington University in St. Louis) EFRAIM BENMELECH

( Northwestern University &

NBER) PAOLA SAPIENZA

(Northwestern University & NBER) LUIGI ZINGALES

( University of Chicago & NBER)

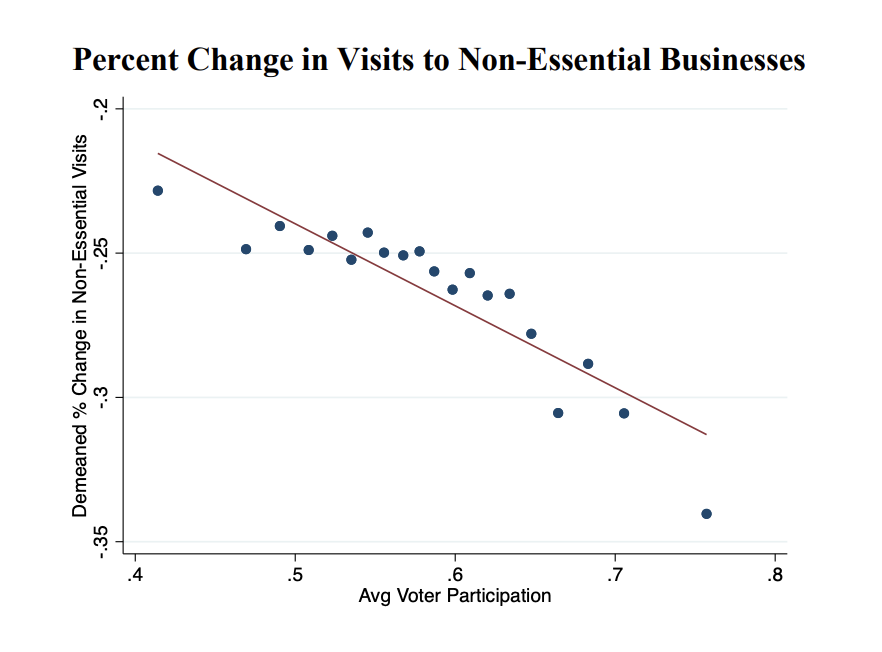

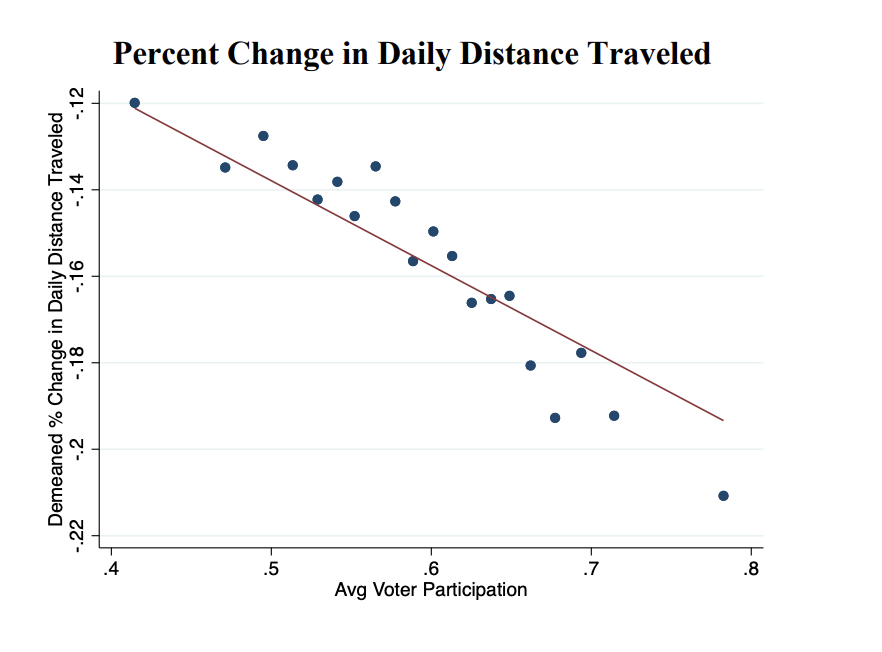

Using mobile phone and survey data, we show that during the early phases of COVID-19, voluntary social

distancing was greater in areas with higher civic capital and amongst individuals exhibiting a higher sense of

civic duty. This effect is robust to including controls for political ideology, income, age, education, and other

local-level characteristics. This result is present for U.S. individuals and U.S. counties as well as European

regions. Moreover, we show that after U.S. states began re-opening, high civic capital counties maintained a

more sustained level of social distancing, while low civic capital counties did not. Finally, we show that U.S.

individuals report a higher tendency to use protective face masks in high civic capital counties. Our evidence

points to the importance of considering the level of civic capital in designing public policies not only in

response to pandemics, but also more generally.

PDF

November 11, 2020

RISK PERCEPTIONS AND POLITICS:

EVIDENCE FROM THE COVID-19 PANDEMIC

WITH JOHN M. BARRIOS (Washington University in St. Louis)

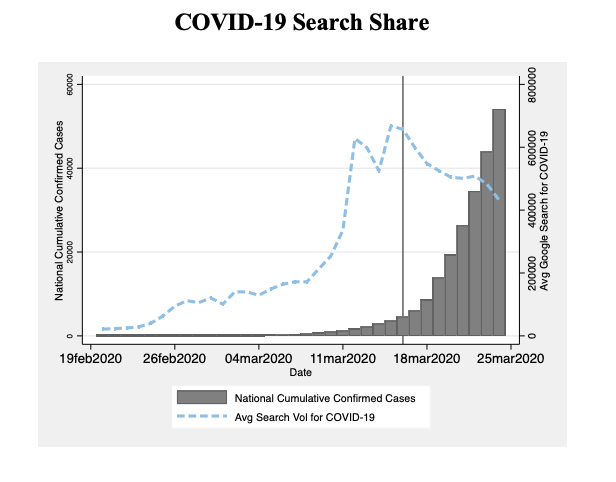

Politics may color interpretation of facts, and thus perceptions of risk, the formation of expectations, and

choices. We find that a higher share of Trump voters in a county is associated with lower perceptions of risk

during the COVID-19 pandemic. Controlling for case counts and deaths in the local area, as Trump's vote

share rises, individuals search less for information on the virus and its potential economic impacts, and engage

in fewer visits to non-essential businesses—suggesting less reallocation of consumer activity across categories.

These patterns persist in the face of state-level guidelines to “stay home,” and reverse only when conservative

politicians are exposed and the White House releases federal social distancing guidelines. We find support for

a media channel as an explanation for our findings, though we cannot rule out that some individuals are

motivated instead by rejection of mainstream views. Our results suggest that politics and the media may play

an important role in determining the formation of risk perceptions, and may therefore affect both economic

and health-related reactions to unanticipated health crises.

PDF

April 7, 2019

National Science Foundation SciSIP Grant Recipient (~$450K)

Kauffman Foundation Grant Recipient ($20K)

The Design of Startup Accelerators

WITH SUSAN COHEN

(University of Georgia)

DANIEL C. FEHDER

(University of Southern California & MIT)

Fiona Murray

(MIT Sloan & NBER)

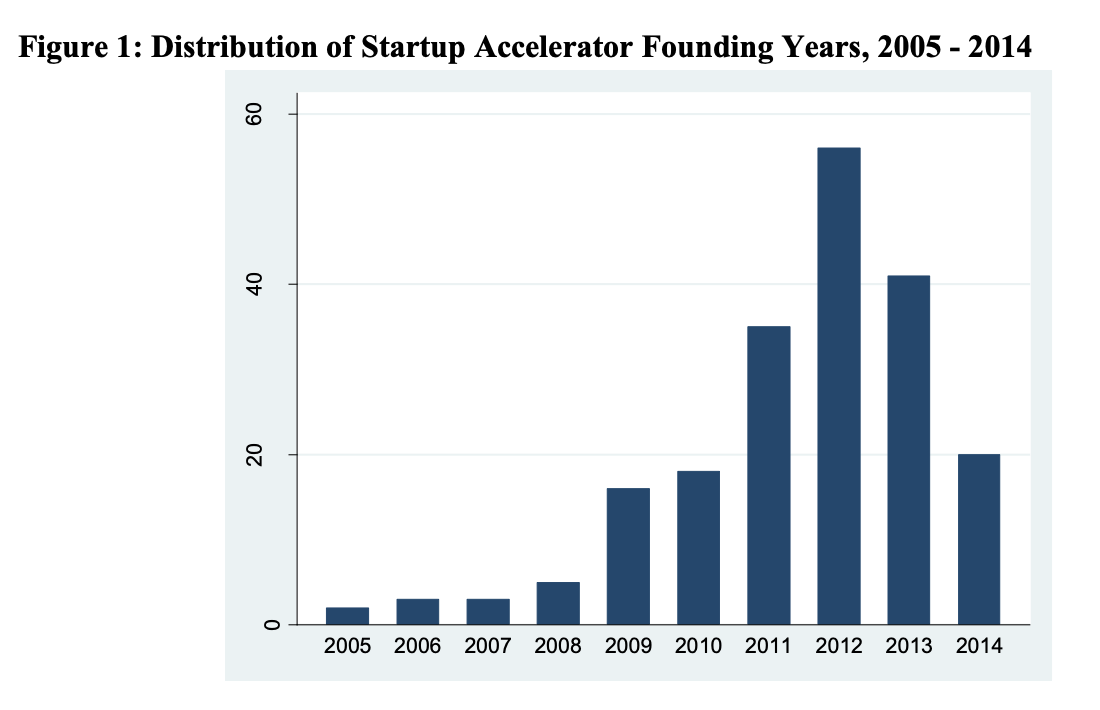

Accelerator programs are an increasingly important part of entrepreneurial ecosystems. While

accelerators have core defining features—fixed-term, cohort-based educational and mentorship

programs for startups—there is also significant variation amongst them. In this paper, we relate

key variation in the antecedents, organizational design and operation of these programs to theories

of firm-level entrepreneurial performance. We then document descriptive correlations between

these design elements and the performance of the startups that attend these programs. In doing so,

we probe the connections between design and performance in ways that integrate previously

disparate research on accelerators and expand our understanding of startup intermediaries. Our

findings delineate the building blocks as well as an agenda for future researchers to build upon not

only our understanding of accelerators, but also our understanding of what new ventures need to

survive and flourish.

PDF

April 2017

ICPM Grant Recipient

POLITICAL REPRESENTATION AND GOVERNANCE: EVIDENCE FROM THE

INVESTMENT DECISIONS OF PUBLIC PENSION FUNDS

WITH ALEXANDER ANDONOV (Erasmus University & NBER) JOSHUA D. RAUH (Stanford University & NBER)

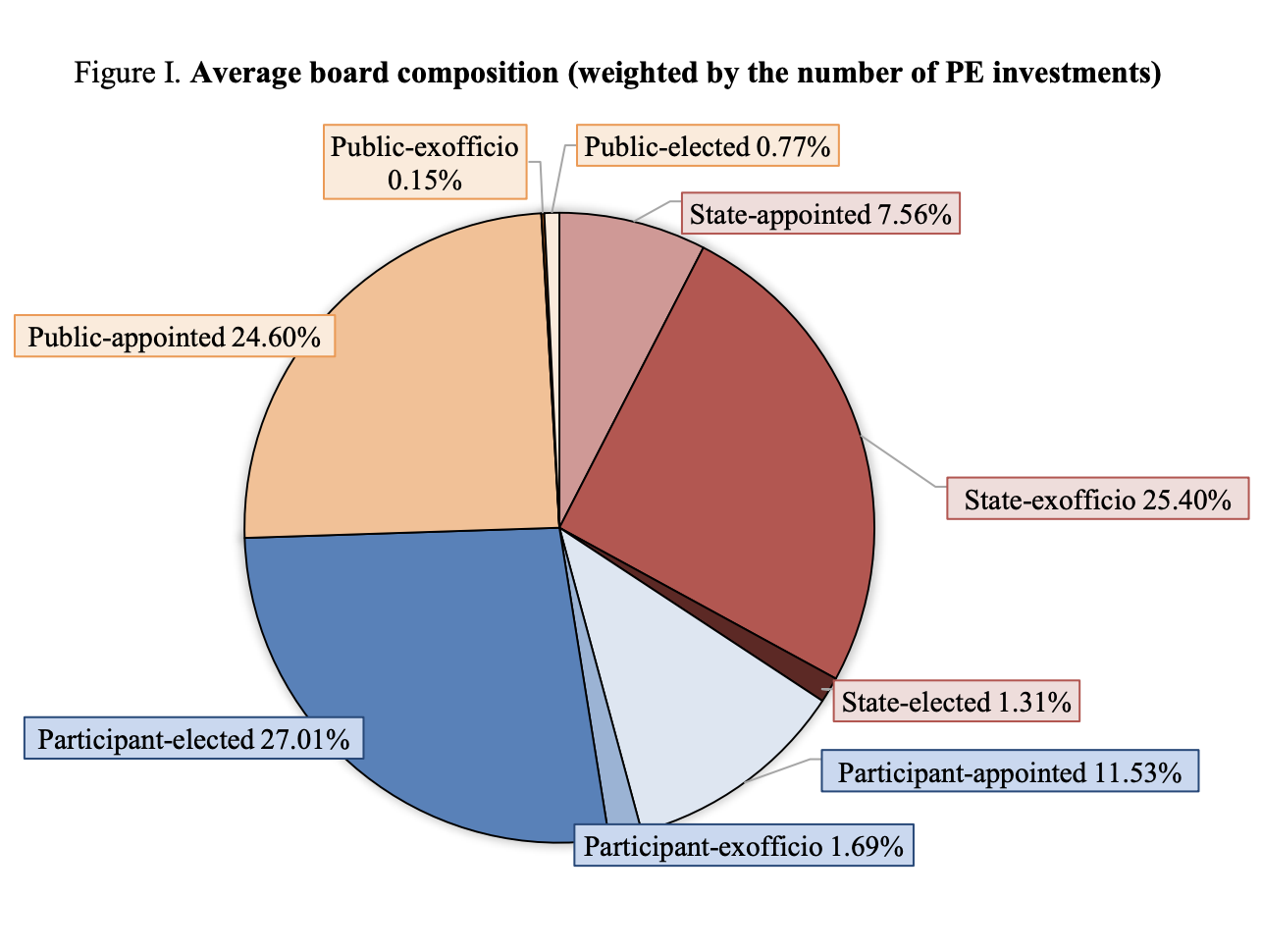

We examine how political representatives affect the governance of organizations. Our laboratory is public pension

funds and their investments in the private equity asset class. Representation on pension fund boards by state officials

or those appointed by them—often determined by statute decades past—is strongly and negatively related to the

performance of private equity investments made by the fund. Funds whose boards have high fractions of government

officials choose poorly within investment categories potentially related to economic development, such as real estate

and venture capital. They overweight investments in in-state funds, as well as in funds that are small, have

inexperienced GPs, and have few other investors. Lack of financial experience contributes to poor performance of

boards dominated by plan participants, but does not explain the underperformance of boards heavily populated by

state officials. Political contributions from the finance industry to elected state officials on pension fund boards are

strongly and negatively related to performance, but do not fully explain the performance differential.

PDF

April 7, 2017

NBER IPE Research Grant, 2014

PATENT COLLATERAL,INVESTOR COMMITMENT, AND THE

MARKET FOR VENTURE LENDING

WITH CARLOS J. SERRANOT (Universitat Pompeu Fabra & Barcelona GSE) ROSEMARIE H. ZIEDONIS (Boston University & NBER)

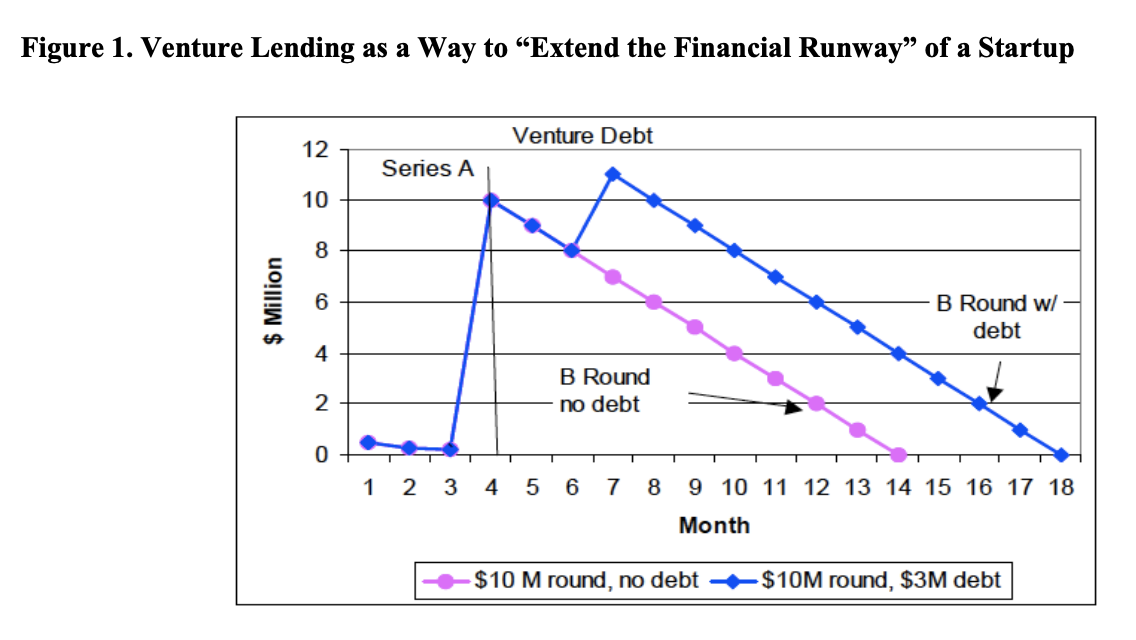

This paper investigates the market for lending to technology startups (i.e., venture

lending) and examines two mechanisms that may facilitate trade within it: (1) the

‘salability’ of patent collateral; and (2) the credible commitment of existing

equity investors. We find that intensified trading in the secondary patent market

is strongly related to the annual rate of startup lending, particularly for startups

with more redeployable patent assets. Moreover, we show that the credibility of

venture capitalist commitments to reinvest in their startups’ next round of

financing can be critical for startup debt provision. Utilizing the crash of 2000 as

a severe and unexpected capital supply shock for VCs, we show that lenders

continue to finance startups with recently funded investors better able to credibly

commit to refinance their portfolio companies, but withdraw from otherwisepromising projects that may have needed their funds the most. The findings are

consistent with predictions of incomplete contracting and financial intermediation

theory.

PDF

October 24, 2016

Real Estate Research Institute Grant, 2010

Market Timing and Investment Selection:

Evidence from Real Estate Investors

WITH TOBIAS MUHLHOFER (University of Miami)

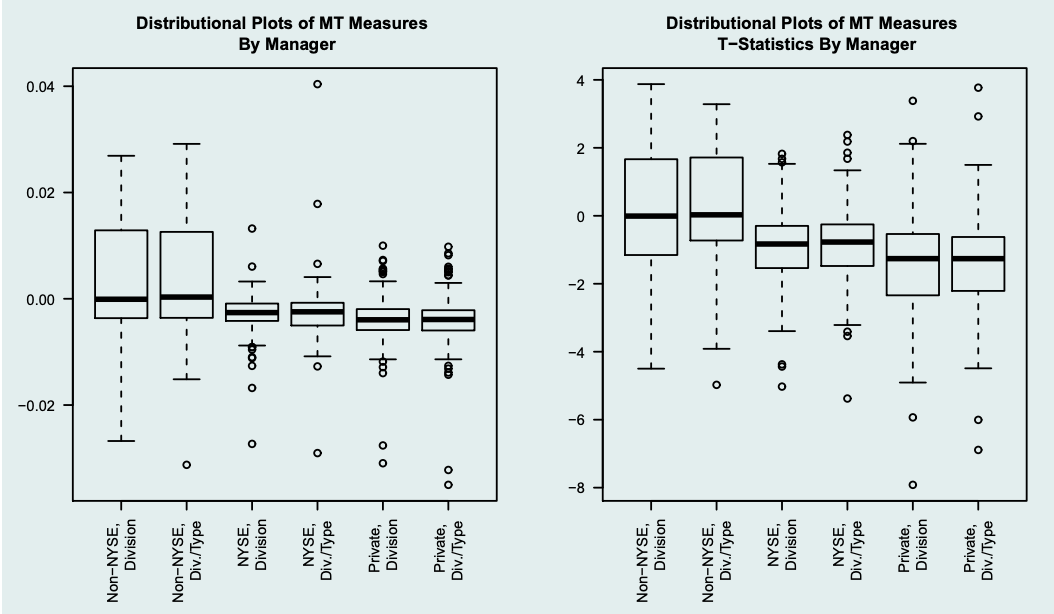

We examine commercial real estate fund managers’ abilities to generate

abnormal profits through selection of outperforming property sub-market

segments or through the timing of entry into and exit from sub-markets. The

vast majority of portfolio managers exhibit little market timing ability, with the

exception of non-NYSE REITs after the financial crisis. A substantial fraction of

managers seem able to successfully select property sub-markets. Selection

performance exhibits significant persistence. Managers that are active in more

liquid markets tend to exhibit better timing performance, while managers

exhibiting better selection ability appear to be active in less liquid markets.

PDF

April 3, 2015

Accelerating Entrepreneurs and Ecosystems: The Seed Accelerator

Model

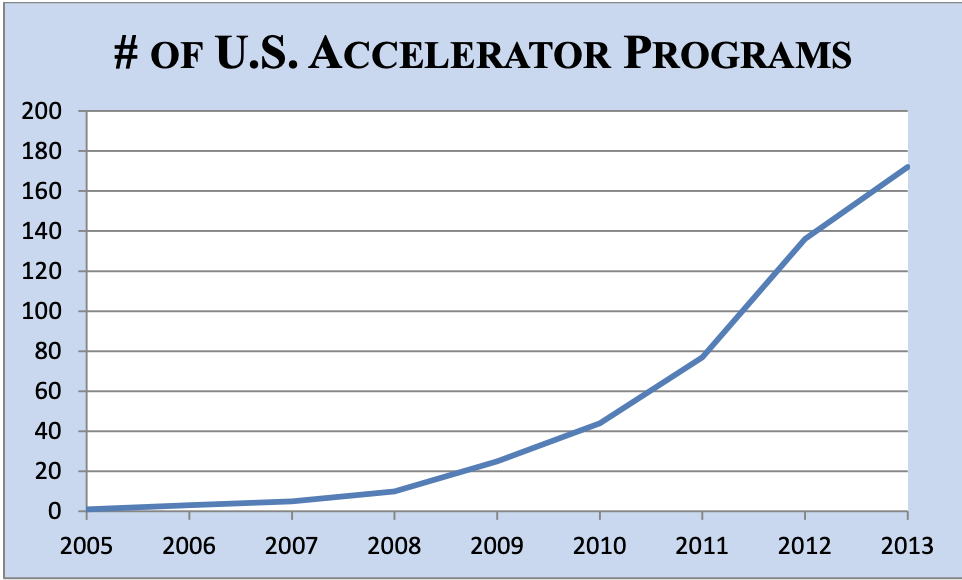

Recent years have seen the emergence of a new institutional form in the entrepreneurial ecosystem: the

seed accelerator. These fixed-term, cohort-based, "boot camps" for startups offer educational and

mentorship programs for startup founders, exposing them to wide variety of mentors, including former

entrepreneurs, venture capitalists, angel investors, and corporate executives; and culminate in a public

pitch event, or "demo day," during which the graduating cohort of startup companies pitch their

businesses to a large group of potential investors. In practice, accelerator programs are a combination of

previously distinct services or functions that were each individually costly for an entrepreneur to find and

obtain. The accelerator approach has been widely adopted by private groups, public and government

efforts, and by corporations. While proliferation of accelerators is clearly evident, with worldwide

estimates of 3000+ programs in existence, research on the role and efficacy of these programs has been

limited. In this article, I provide an introduction to the accelerator model and summarize recent evidence

on their effects on the regional entrepreneurial environment.

PDF

April 3, 2015

Specialization and Competition in the Venture Capital Industry

WITH MICHAEL J. MAZZEO (Northwestern University) Ryan C. McDevitt (Duke University)

An important type of product differentiation in the venture capital (VC) market is

industry specialization. We estimate a market structure model to assess competition

among VCs -- some of which specialize in a particular industry and others of which are

generalists -- and find that the incremental effect of additional same-type competitors

increases as the number of same-type competitors increases. Furthermore, we find that the

effects of generalist VCs on specialists are substantial, and larger than the effect of sametype competitors. Estimates from other industries typically show the incremental effects

falling as the number of same-type competitors increases and the effects of same-type

competitors as always being larger than the effects of different-type competitors.

Consistent with the presence of network effects that soften competition, these patterns are

more pronounced in markets that exhibit dense organizational networks among incumbent

VCs. Markets with sparser incumbent networks, by contrast, exhibit competitive patterns

that resemble those of other, non-networked industries.

PDF

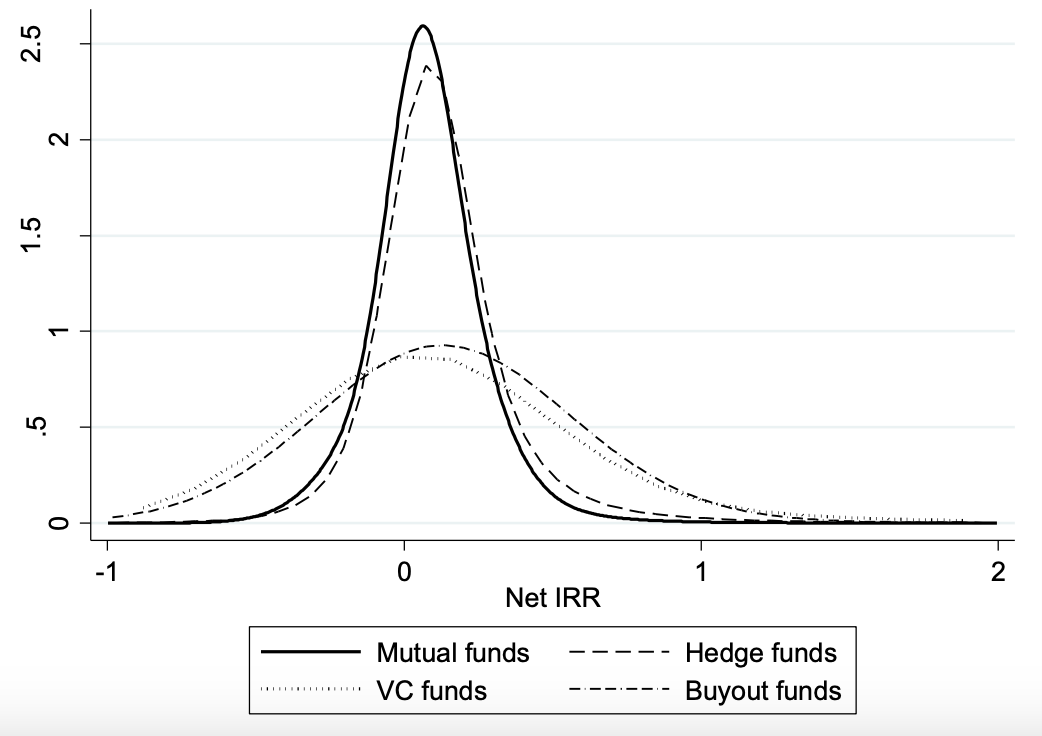

October 16, 2012

Prize for Best Private Equity Paper, European Financial Association 2009

Informational Hold-up and Performance Persistence in

Venture Capital

WITH ALEXANDER LJUNGQVIST (New York University, CEPR & NBER) ANNETTE VISSING JORGENSEN (Northwestern University, CEPR & NBER)

Why don’t successful venture capitalists eliminate excess demand for their follow-on funds

by aggressively raising their performance fees? We propose a theory of learning that leads to

informational hold-up in the VC market. Investors in a fund learn whether the VC has skill or

was lucky, whereas potential outside investors only observe returns. This gives the VC’s current

investors hold-up power when the VC raises his next fund: Without their backing, he cannot

persuade anyone else to fund him, since outside investors would interpret the lack of backing as

a sign that his skill is low. This hold-up power diminishes the VC’s ability to increase fees in

line with performance. The model provides a rationale for the persistence in after-fee returns

documented by Kaplan and Schoar (2005). Empirical evidence from a large sample of U.S. VC

funds is consistent with the model. We estimate that up to 68.7% of VC firms lack skill.

PDF

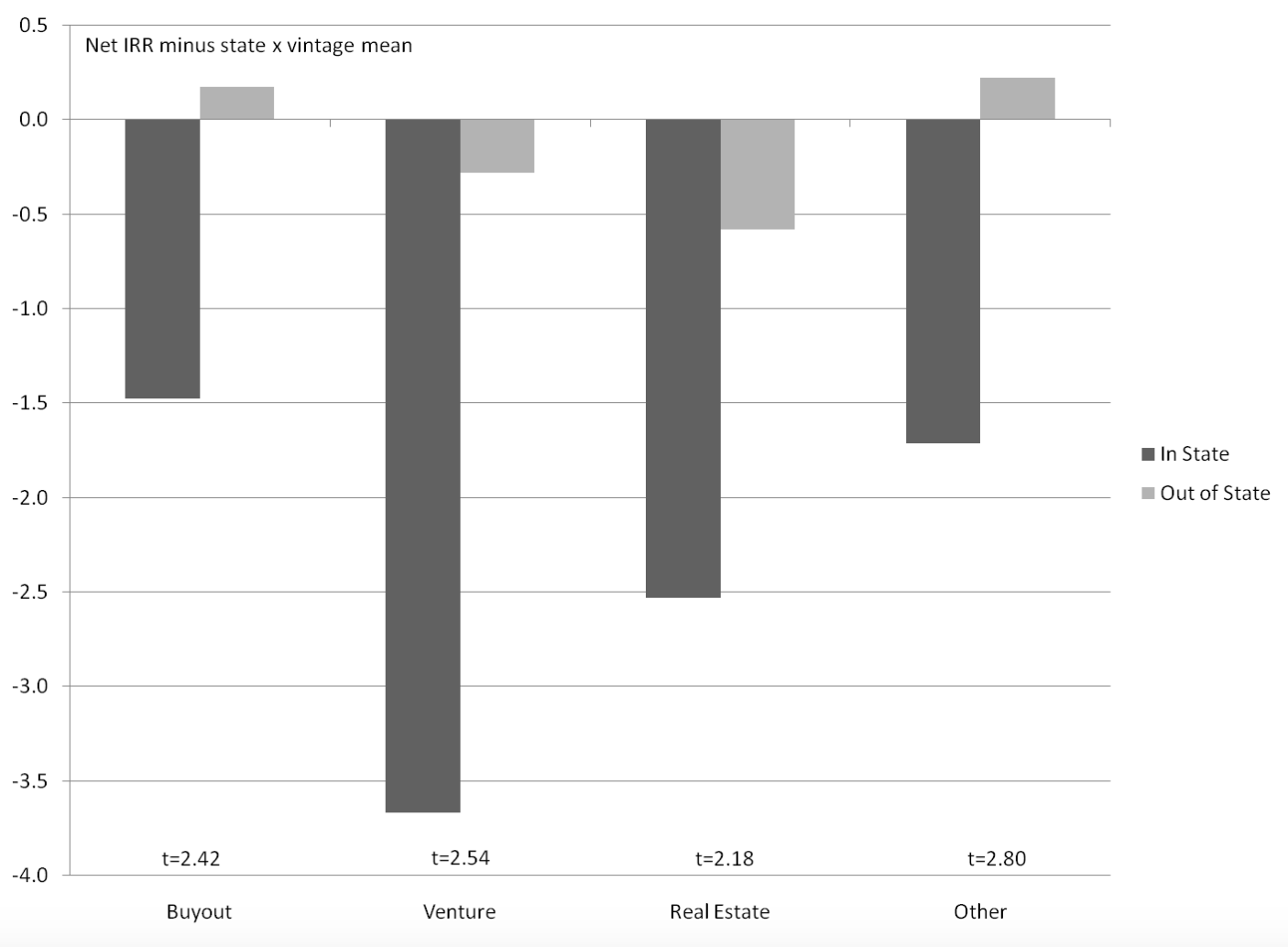

October 2012

Local Overweighting and Underperformance: Evidence from Limited

Partner Private Equity Investments

WITH JOSHUA D. RAUH (Stanford University & NBER)

Institutional investors exhibit substantial home-state bias in private equity. This effect is particularly

pronounced for public pension fund investments in venture capital and real estate. Public pension funds

achieve performance on in-state investments that is 2-4 percentage points lower than both their own

similar out-of-state investments and similar investments in their state by out-of-state investors. States with

political climates characterized by more self-dealing invest a larger share of their portfolio locally.

Relative to the performance of the rest of the private equity universe, overweighting and

underperformance in local investments reduce public pension fund resources by $1.2 billion per year.

PDF

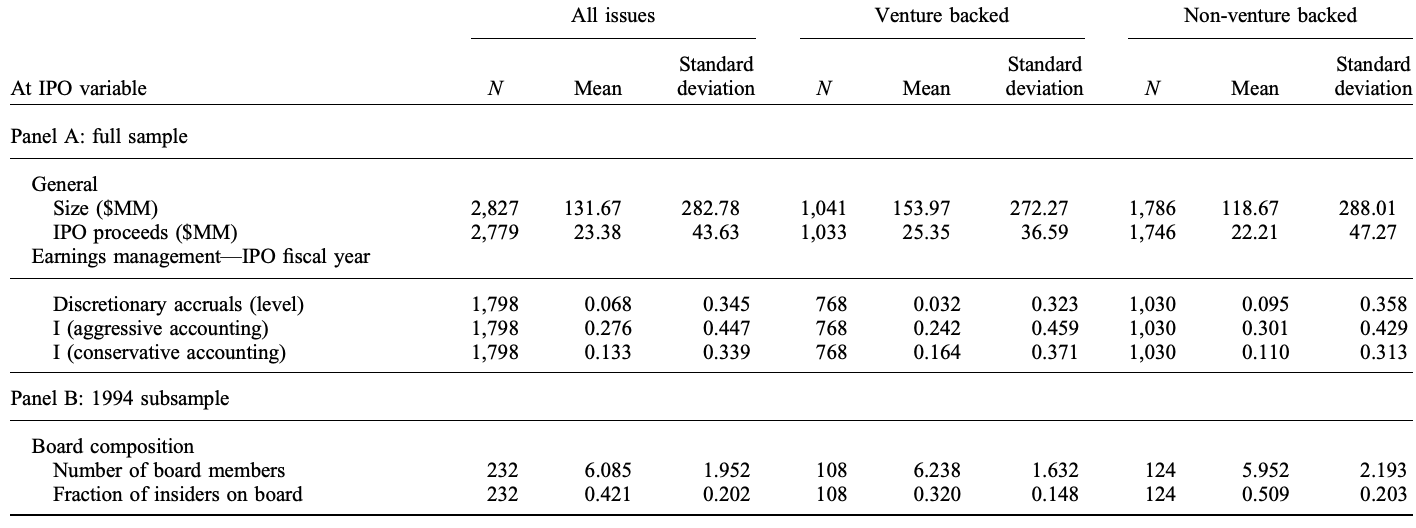

October 2012

Venture Capital and Corporate Governance in

the Newly Public Firm

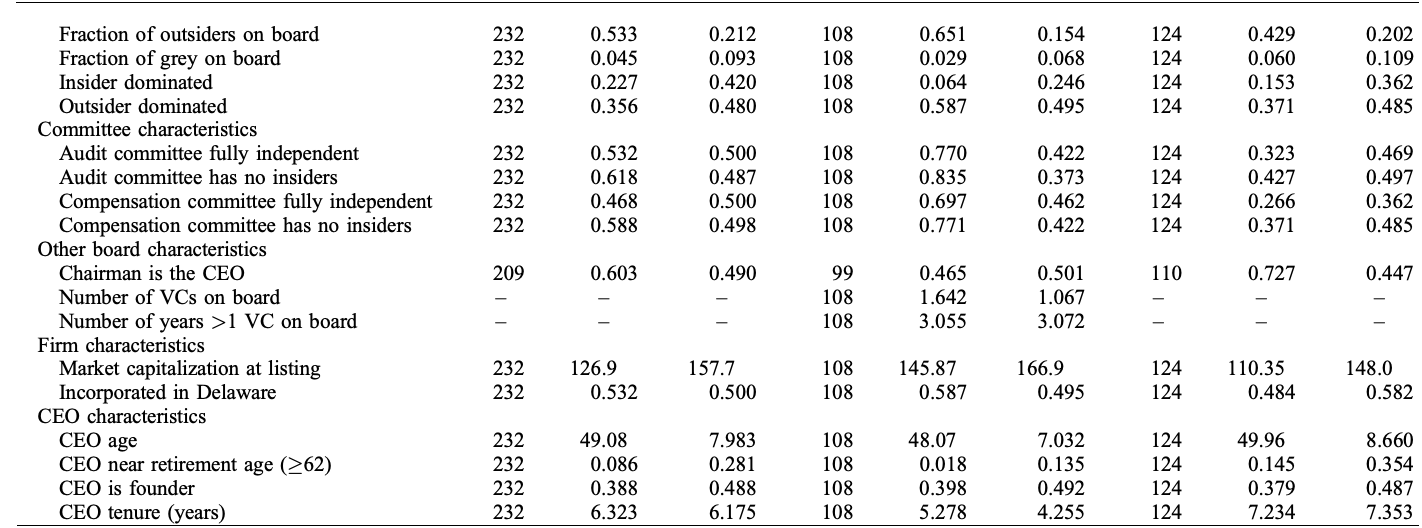

I examine the effects of venture capital backing on the corporate governance of the entrepreneurial firm at the time of transition from private to public ownership. Using a selection model

framework that instruments for venture backing with variations in the supply of venture capital, I

conduct three sets of tests comparing corporate governance in venture- and non–venture-backed initial public offering (IPO) firms. Venture-backed firms have lower levels of earnings management,

more positive reactions to the adoption of shareholder rights agreements, and more independent board

structures than similar non–venture-backed firms, consistent with better governance. These effects are

not common to all pre-IPO large shareholders.

PDF

2010

Financial Services Exchange Grant Recipient, Searle Grant Recipient

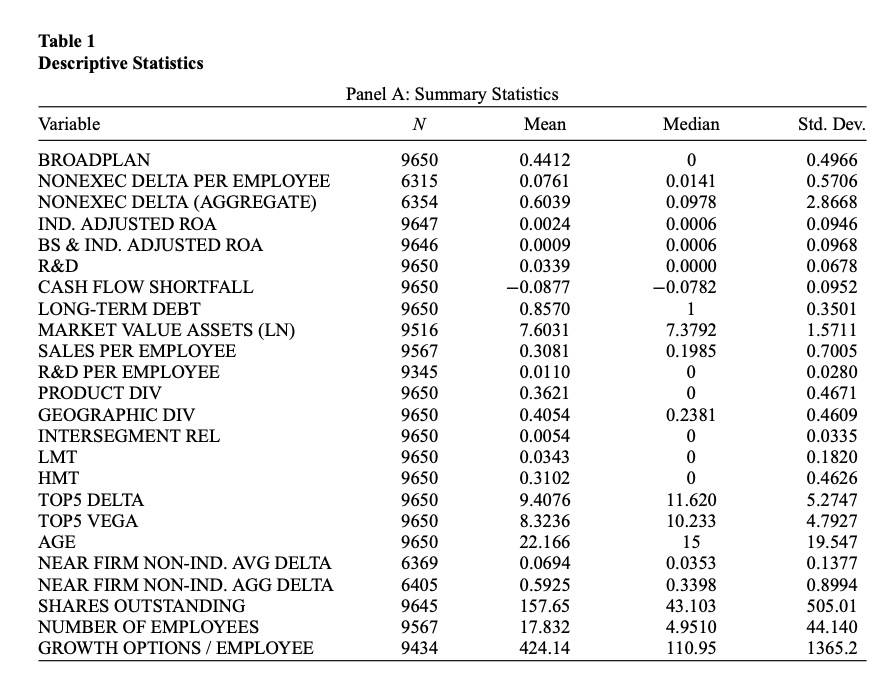

Incentives, Targeting, and Firm Performance:

An Analysis of Non-executive Stock Options

WITH LAURA LINDSEY (Arizona State University)

We examine whether options granted to non-executive employees affect firm performance.

Using new data on option programs, we explore the link between broad-based option programs, option portfolio implied incentives, and firm operating performance, utilizing an

instrumental variables approach to identify causal effects. Firms whose employee option

portfolios have higher implied incentives exhibit higher subsequent operating performance.

Intuitively, the implied incentive-performance relation is concentrated in firms with fewer

employees and in firms with higher growth opportunities. Additionally, the effect is concentrated in firms that grant options broadly to non-executive employees, consistent with

theories of cooperation and mutual monitoring among co-workers.

PDF

2010

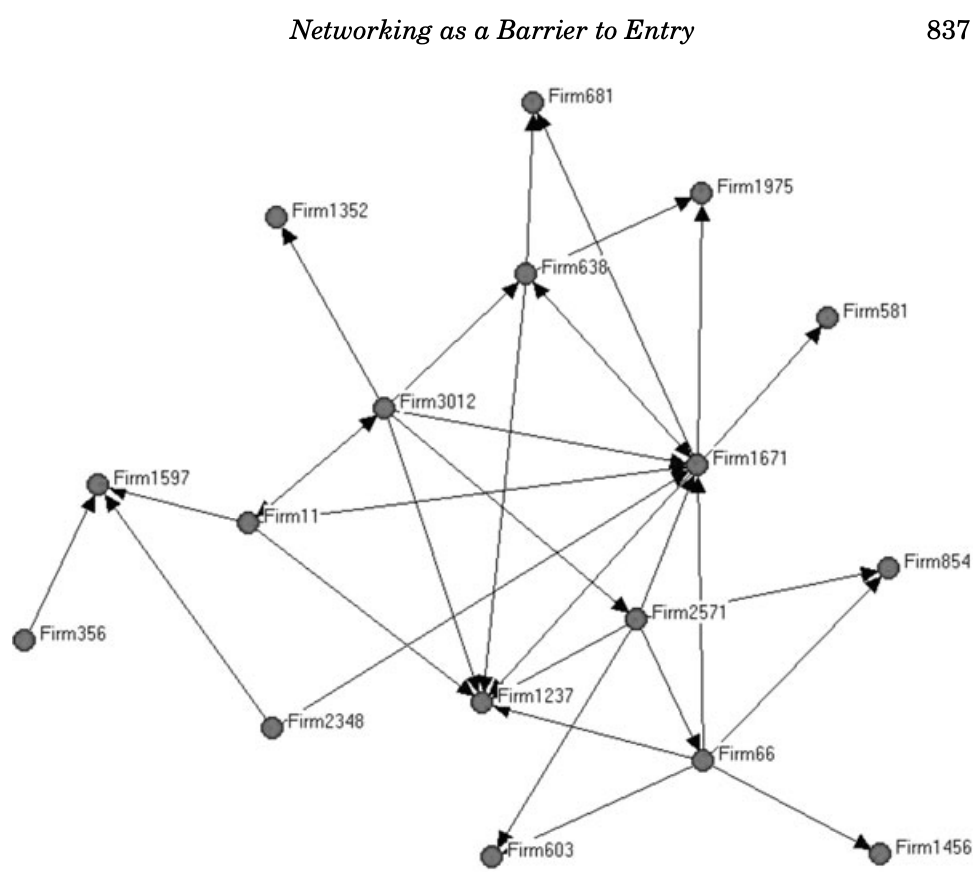

Networking as a Barrier to Entry and the

Competitive Supply of Venture Capital

WITH ALEXANDER LJUNGQVIST YANG LU

We examine whether strong networks among incumbent venture capitalists (VCs)

in local markets help restrict entry by outside VCs, thus improving incumbents’

bargaining power over entrepreneurs. More densely networked markets experience

less entry, with a one-standard deviation increase in network ties among incumbents

reducing entry by approximately one-third. Entrants with established ties to targetmarket incumbents appear able to overcome this barrier to entry; in turn, incumbents

react strategically to an increased threat of entry by freezing out any incumbents who

facilitate entry into their market. Incumbents appear to benefit from reduced entry

by paying lower prices for their deals.

PDF

November 30, 2008

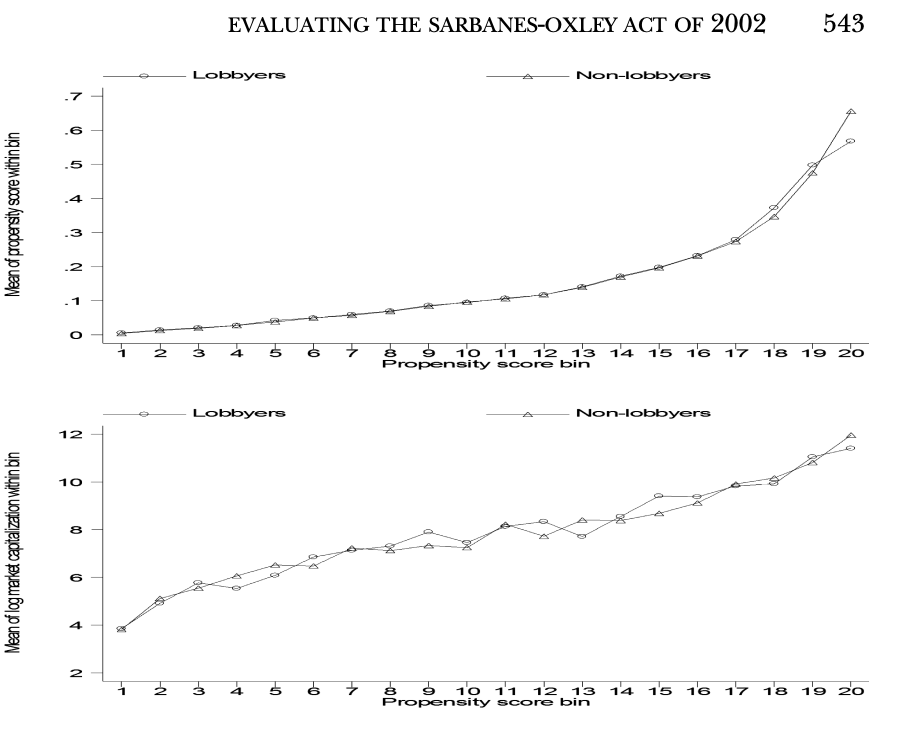

A Lobbying Approach to Evaluating

the Sarbanes-Oxley Act of 2002

WITH PAOLA SAPIENZA ANNETTE VISSING-JORGENSEN

We evaluate the impact of the Sarbanes-Oxley Act (SOX) on shareholders by

studying the lobbying behavior of investors and corporate insiders in order to

affect the final implemented rules under SOX. Investors lobbied overwhelmingly in favor of strict implementation of SOX, while corporate insiders and

business groups lobbied against strict implementation. We identify firms most

affected by the law as those whose insiders lobbied against strict implementation. Such firms appear to be characterized by agency problems, rather than

motivated by concerns over compliance costs. Cumulative stock returns during the five and a half months leading up to SOX passage were approximately

7% higher for corporations whose insiders lobbied against SOX disclosurerelated provisions than for similar non-lobbying firms, consistent with an expectation that SOX would reduce agency problems. Analysis of returns in the

post-passage implementation period suggests that investors’ positive exp

PDF

September 3, 2007

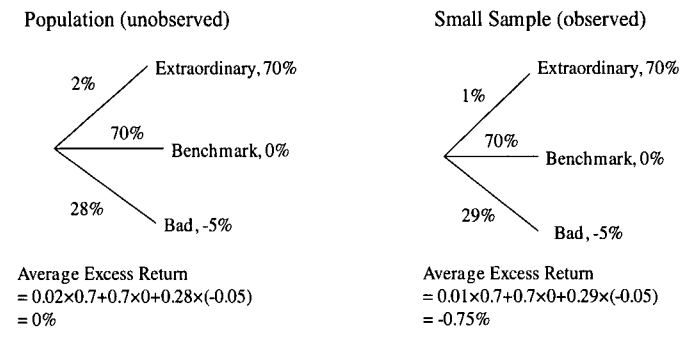

Is IPO Underperformance a Peso Problem?

WITH ANDREW ANG LI GU

Recent studies suggest that the underperformance of IPOs in the post-1970 sample may

be a small sample effect or "Peso problem." That is, IPO underperformance may result

from observing too few star performers ex post than were expected ex ante. We develop

a model of IPO performance that captures this intuition by allowing returns to be drawn

from mixtures of outstanding, benchmairk, or poor performing states. We estimate the

model under the null of no ex ante average IPO underperformance and construct small

sample distributions of various statistics measuring IPO relative performance. We find that

small sample biases are extremely unlikely to account for the magnitude of the post-1970

IPO underperformance observed in data.

PDF

February, 2007

Top-cited paper in the Journal of Finance , 2008

Winner of Emerald Citation of Excellence award, 2011 and 2014

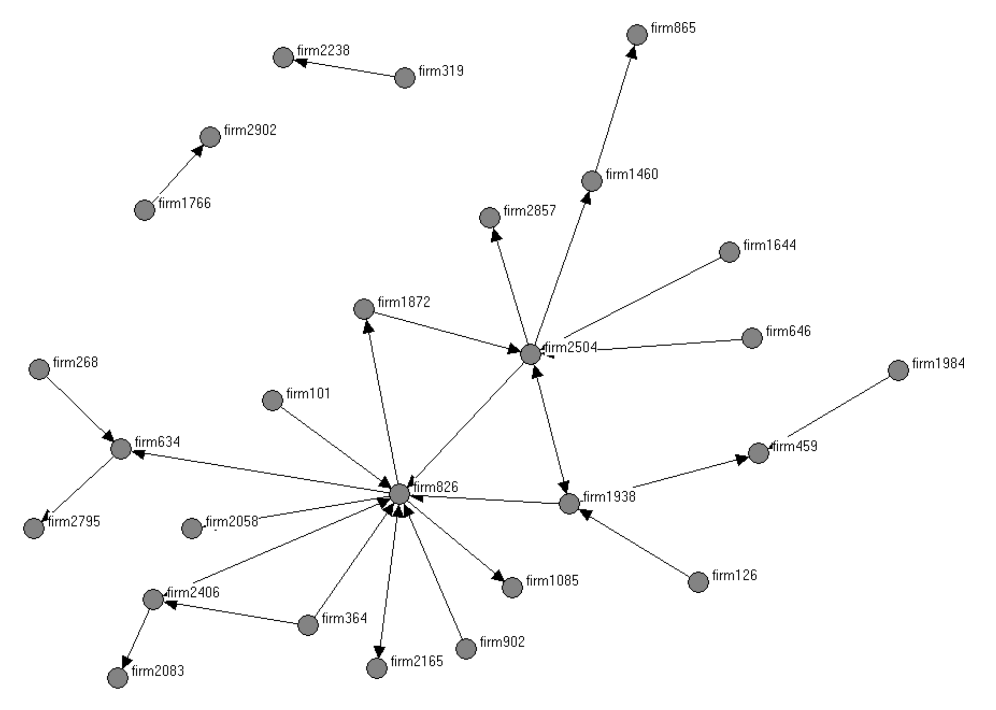

Whom You Know Matters: Venture Capital

Networks and Investment Performance

WITH ALEXANDER LJUNGQVIST YANG LU

Many financial markets are characterized by strong relationships and networks,

rather than arm’s-length, spot market transactions. We examine the performance consequences of this organizational structure in the context of relationships established

when VCs syndicate portfolio company investments. We find that better-networked

VC firms experience significantly better fund performance, as measured by the proportion of investments that are successfully exited through an IPO or a sale to another

company. Similarly, the portfolio companies of better-networked VCs are significantly

more likely to survive to subsequent financing and eventual exit. We also provide

initial evidence on the evolution of VC networks.

PDF